In this article we want to address common questions related to MasterWord’s payment terms.

Question: The Independent Contractor Agreement states: “MasterWord shall pay Contractor net thirty (30) days following receipt and approval of a properly prepared and submitted invoice.” What does it mean?

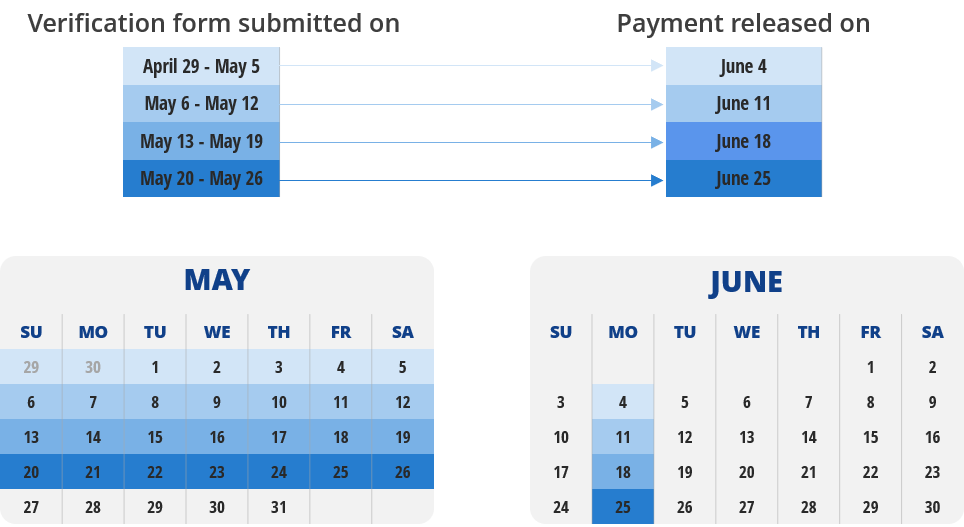

Answer: All payments are made net 30 days from the receipt of an approved Interpreting Services Verification Form or other valid documented evidence as verified and accepted by MasterWord’s Accounting Department. Please note that net 30 days starts from the receipt (i.e. from the date you uploaded the record to the LP Portal) not from the date MasterWord’s Accounting staff approved it. The date of your upload is automatically tracked by the system.

MasterWord releases payments every week in a single batch (usually a Monday, except when a Monday is a federal holiday, then the payments are released on a Tuesday). Federal holidays include: New Year’s Day, Martin Luther King, Jr., Washington’s Birthday, Memorial Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving Day, and Christmas Day.

An example of the process can be seen below.

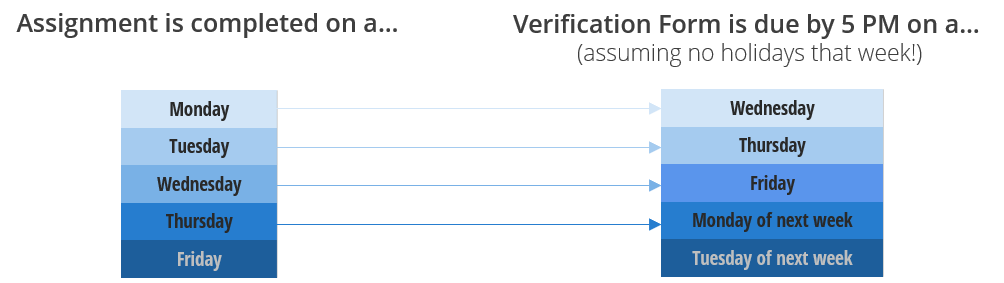

Question: Interpreting Services Terms and Conditions state: “A properly completed Interpreting Services Verification Form must be submitted within two (2) business days after the completion of each interpreting assignment.” What does it mean?

Answer: Business each business day ends at 5 pm Monday through Friday (except for holidays). Any records submitted after 5 pm are considered the next business day’s submission. Here is a sample chart of what is considered two business days:

Question: As it relates to Spoken Language Interpreting Services, Terms and Conditions state: “If an invoice is not provided to MasterWord within two (2) business days, due to MasterWord’s clients’ billing policies untimely invoiced services no longer qualify as billable hours and we are unable to bill the client in the next cycle. Therefore, untimely submitted invoices will be paid at a reduced rate of $5.00 USD per each hour of untimely invoiced rendered interpreting services. No additional expenses will be paid on a late invoice. Additionally, any invoice submitted after net thirty (30) days of service completion is not compensable and will not be accepted for payment.” What does it mean?

Answer: The only form of evidence we have that the interpreting services were provided is your signed verification form (or another client required form) that you submit to MasterWord after your interpreting assignment is completed. If you delay the submission of your verification form, it in turn delays our ability to invoice our clients. Our clients have strict invoicing policies and if we do not invoice on time, we may not get reimbursed by client or may be penalized for the delay in invoicing. That is why we often stress the importance of submitting your verification form as soon as possible, preferably the same day you completed the assignment, but no later than 2 business days. This allows us to maintain an uninterrupted invoicing cycle.

If you delay submitting your invoice/verification form to us, it results in our inability to bill the client in a timely manner and, thus, leads to a reduced rate paid to you ($5 for each hour of service) for any invoice that you submit after 2 business days and up to net 30 days. Additionally, because we are not able to bill the client for late invoices, any other expenses that were pre-approved (such as mileage, travel fee, parking, etc.) but that you failed to invoice on time within 2 business days will not be compensated to you.

And finally, if you submit your invoice/verification form after net 30 days, it will not be paid.

Please help us process your payments on time by submitting your interpreting services verification forms and other client required forms in a timely manner.

Question: Where can I find a payment schedule for the current calendar year?

Answer: The Expected Payment Schedule for the current calendar year is available at this link.